Understanding Social Media "Insanity"

Sunday, May 27, 2012 at 9:05PM

Sunday, May 27, 2012 at 9:05PM "Insanity is relative. It depends on who has who locked in what cage." ~ Ray Bradbury

Well the Facebook IPO has been completed, and the first crazy thing we might consider is the diversity of opinions on the success or failure of the IPO. Put me in the "success" camp -- the objective of an IPO is to raise money in exchange for a share of the company. Offering shares at $38 was a great deal for Facebook, and if the market now values those shares at 16% less, that only reinforces the notion that Facebook got an impressive price for its shares.

The valuation of Facebook is a second insanity that we might consider. Most analysts have focused on the monetization of pageviews, noting (for example) that Google generates a lot more revenue per pageview, and that this speaks of strong monetization upside potential for Facebook. This may be so, but we should also consider that Facebook is a media channel, and that there are a booming number of media channels competing for eyeballs and online time.

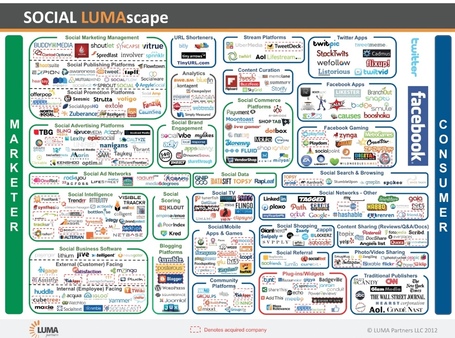

Business Insider started all this with their article: This INSANE Graphic Shows How Ludicrously Complicated Social Media Marketing Is Now. That graphic, as well as the more florid one here: The Conversation Prism show hundreds of competitors for a slice of the social pie.

So many companies, so little time. Why do they bother? Why would another company ply the Social space? Sure, Google and Facebook might buy a bunch of them, but why should Google and Facebook do that? To clear up this seeming insanity, let's take a look at how eyeballs and share might work in a social media space. To sort things out we'll apply a technique called Markov Analysis to the Social Media space.

Markov analysis is an evaluation approach that uses the current movement of a variable to predict the future movement of that variable. Here we'll look at the "Url Shortener" subset of the Social space, but the same approach can be used independent of the number of companies under review. We've played with URL shortener's before, describing them here: Spreadsheets for the New Millennium and implementing one here: MiniURLs for the Masses, but this time we're going to look at three of the leading URL shortener offerings: bit.ly, tinyarrows and tinyurl.com.

To get started with our analysis we need to look at the current share for our providers and to get a sense of where customers come from for each of our providers, Bit.ly, TinyArrows and TinyURL. A hypothetical model of that information is presented in what is called a Transition Table, as shown below:

Here's how to read a Transition Table:

- Start with initial customer counts and market share

- For each provider and each competitor, note the gains and losses for the time period in question

- A single "play" of the Transition Table takes us from May market share to June market share

Microsoft Excel is not a bad place to start for share analyses, but for our calculations (and for a greater number of providers, certainly) we'll want a more powerful tool with Matrix math and/or linear algebra functionality, like NumPy (for Python), or linalg (for Fortran through Ruby). For the purposes of this review, I'll use Mathematica to show the essential matrix calculations that can show us evolving Markov analysis for estimating market share.

In this analysis we'll use a first-order Markov process, and assume that the customer purchase decision for each month depends only on the choices available for that month. Studies have shown that first order Markov processes can be successful at predicting web behavior, particularly if the transition matrix is stable.

We can load our transition matrix into Mathematica, where the Mathematica transition matrix vectors are generated by calculating losses to competitors: Bit.ly (for example), kept 920 customers in May, but lost 23 to TinyArrows and 57 to TinyURL, yielding their vector of {.920, .023, .057 }.

The result is shown below:

The key to Markov analysis is the ability to determine or estimate the number of customers gained-from and lost-to competitors. Web analytics can often provide an estimate for such customer migrations, as can the results of a "competitive upgrade" marketing program.

Markov analysis for a single month can show meaningful transitions, but a more useful analysis can be had when

- The transition matrix is assumed to be stable, and

- The model is used to determine equilibrium market shares

Such an analysis is shown below:

As we might guess from the initial transition table, this is a very favorable market for Bit.ly, based in the hypothetical numbers presented here. Bit.ly started with an even share of the market, but will evolve to nearly double the market share of its competitors with the transition table shown here. If there are second-order effects (such as Bit.ly being seen as a "leader" in potential customers' eyes) then the share gain my be even larger than that shown here.

But that's not the only fascinating thing about Markov analysis here. It's not where you start the game, but how well you play it. If we keep the transition matrix constant (i.e. how the game is played), then even if we drop Bit.ly and Tinyarrows to 1% market share and play the game to equilibrium, we still end up with the same basic equilibrium that we'd achieved from even shares! The effect of playing this game to equilibrium is shown below:

So perhaps this is the "Ah HA!" of the crowded social media space, and the reason that small companies keep entering the space to try to carve their niche in it. The model here might suggest the following:

- In a world of compute clouds, the barriers-to-entry for social media startups is low

- The social media space is new enough that many firms with "one-stripe zebra" distinctive competencies might still carve out and defend niches successfully -- they play well

- Publicly traded firms (like Facebook and Google) are compelled to increase market share and earnings and have powerful incentives to change the nature of competition -- to "shake up" the transition matrix from time to time

- Nothing shakes up a transition matrix like the acquisition of a competitor

- Technology tends to produce natural monopolies, but only if a leader can acquire enough share that higher-order monopolistic effects take over

So -- when all is said and done, it really is in the interest of lots of niche firms to try to carve out a defensible space, and it is in Facebook's and Google's interest to acquire the pieces that let the "natural monopolies" play out.

So -- Social Media "Insanity?" -- "Crazy like a fox" is more like it.

John Repko | Comments Off |

John Repko | Comments Off |